TIAs receive funding from the new property tax revenue generated by the growth in assessed value for properties located in a TIA. Existing property tax revenue continues to be collected by the current taxing districts. Taxing districts temporarily forego some taxes raised from the increase in assessed value in the TIA, and the dollars are directed toward public infrastructure improvements in the TIA. The intent of a TIA is to fund public projects that stimulate growth in assessed value that would not occur without those public projects. Thus, a portion of the foregone tax revenue would not exist without the TIA investments.

The property tax levies imposed on properties within the proposed City of Walla Walla TIA are listed below. Voter approved general obligation bonds are NOT impacted by a TIA. Levies for State and local schools are also NOT impacted by the proposed TIA.

Levies impacted by TIA:

- County Current Expense

- City of Walla Walla Regular

- Port of Walla Walla

- Emergency Medical Services

Levies not impacted by TIA:

- State Schools (Part 1 and 2)

- Walla Walla Public Schools: General and Bond Funds and Reserve Funds

- College Place Public Schools: General, Capital Project, Bond, and Transportation Vehicle Funds

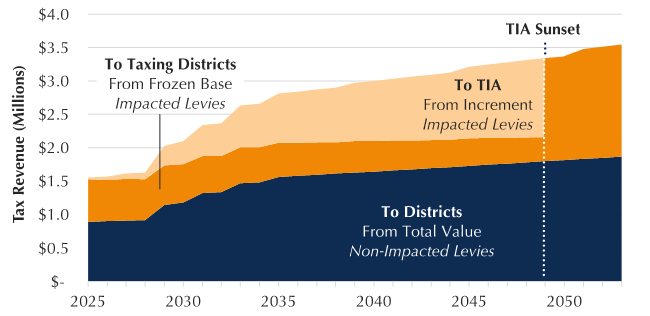

The property taxes being levied on the current assessed value within the TIA boundary will continue to go to the overlapping taxing districts. Property tax revenue from increases in assessed value within the TIA boundary after the TIA is established will go to the City to pay for public improvements within the TIA boundary (called tax allocation revenues and shown in orange on the following chart). This tax allocation revenue is generated from new development in the TIA and from appreciation of existing properties.

Once the TIA has expired (no more than 25 years after receiving its first increment), the overlapping taxing districts will receive the full amount of property taxes from the increased assessed value in the increment area. This is illustrated in the chart below.